Life Insurance

Life insurance helps protect the financial future of your family if something happens to you. It creates an instant estate to help supplement the loss of you or your spouse/domestic partner’s income, making it possible for you to meet monetary responsibilities such as burial expenses, debt, children’s education, mortgage, retirement, and much more.

Help safeguard your family's assets with quality life insuarnce options that are portable.

Life Insurance

Rates are annual renewable and provide up to $2 million in term life benefits for qualified individuals.

Group 10 Year Level Term Insurance*

Rates are guaranteed for an initial 10 year term and provides up to $2 million in coverage for qualified members and their families.

Group 20 Year Level Term Insurance*

Rates are guaranteed for an initial 20 year term and provides up to $2 million in coverage for qualified members and their families.

Group Accidental Death & Dismemberment*

Provides up to $500,000 in case of a covered accidental death or injury.

Also known as key employee insurance, is coverage that protects your small business in case of an untimely death of the business owner or top-performing employee.

* Underwritten by New York Life Insurance Company, New York, NY 10010, under Group Policy GMR.

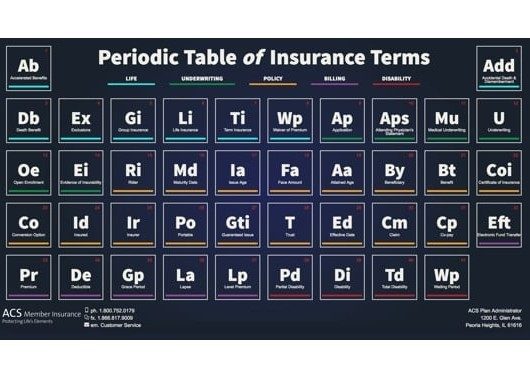

Learn the Insurance Language

Check out the Periodic Table of Insurance Terms.

Related Resources

Explore our Resources section for videos, white papers and articles related.